In the fast-paced world of trading, simulations often serve as the first step for many aspiring traders, offering a safe space to experiment without the consequences of real financial risk. However, the gap between simulated trading and actual market performance can be staggering.

Why is it that what works in a controlled environment often fails in the unpredictable realm of real trading? The answers lie in a multitude of factors—ranging from market conditions and emotional responses to the limitations inherent in simulation software. This article dives deep into the pitfalls that plague trading simulations, exploring how discrepancies in market behavior, order execution, and human psychology can dramatically skew results.

By understanding these shortcomings, traders can better navigate the complexities of the financial markets and refine their strategies for real-world success. So, let’s unpack the reasons your simulations might not be telling the full story and discover actionable steps to bridge that crucial gap.

Common Pitfalls in Trading Simulations

In the realm of trading simulations, several common pitfalls can distort the learning experience and lead traders astray. One prevalent issue is the oversimplification of market conditions; many simulations fail to replicate the chaotic nature of real-life trading—where emotions, geopolitical events, and unexpected market shifts reign supreme.

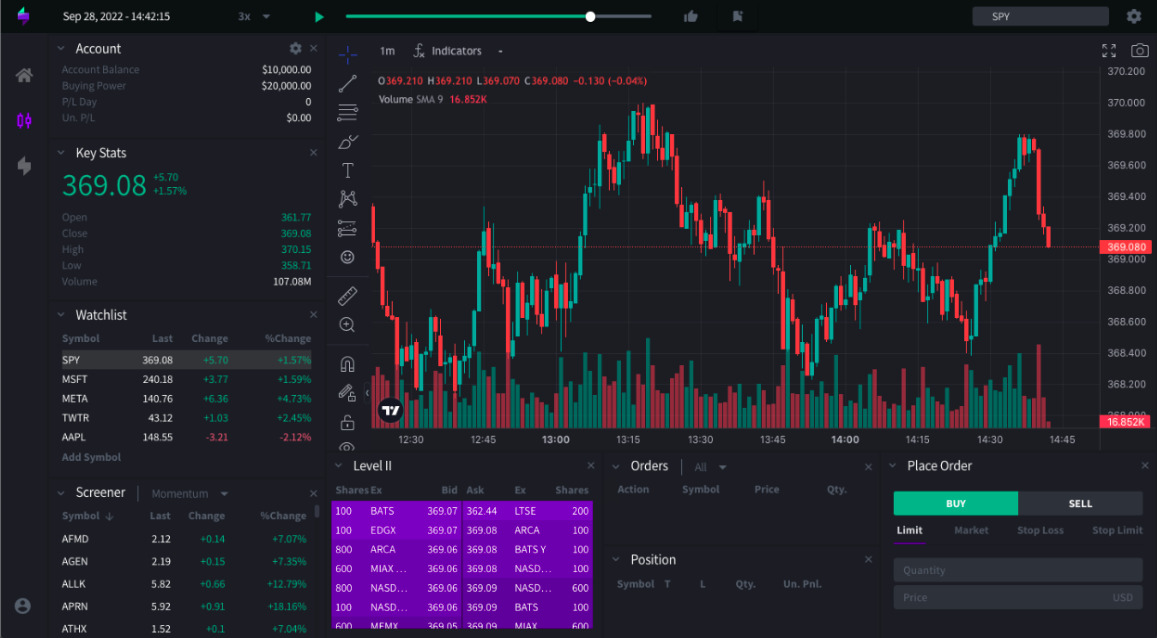

Moreover, traders often unwittingly develop strategies based solely on historical data, neglecting the adaptive thinking required for live markets, where past performance is no guarantee of future results. Tools like depth of market live can address these shortcomings by providing real-time insights into the order book, allowing traders to see the actual liquidity at different price levels and gauge the dynamics of supply and demand. This real-time perspective helps traders experience the fluid and unpredictable nature of live markets, making simulations more reflective of actual trading conditions.

Coupled with this is the tendency to ignore transaction costs, slippage, and liquidity considerations, which can erode profits in real scenarios but are often overlooked in a controlled environment. Lastly, overconfidence can insidiously creep in; a string of simulated victories may inflate a trader’s ego, lulling them into a false sense of security that shatters once they are faced with the trials of actual trading.

Recognizing these pitfalls, and incorporating tools like depth of market live, is crucial for turning simulations into realistic learning tools and paving the way for greater success in the dynamic world of trading.

The Impact of Data Quality on Simulations

The impact of data quality on simulations can be profound, often dictating the fidelity of outcomes. When simulations draw on flawed or incomplete data sets, the results can veer wildly off course, resembling more of a fantasy than a reflection of real trading scenarios.

Inconsistent pricing, outdated historical data, and erroneous transaction records can create a domino effect, leading traders to make misguided decisions based on misleading insights. Conversely, robust, high-quality data fosters accurate modeling, allowing for realistic market dynamics to emerge within the simulation.

This not only enhances predictive power but also instills greater confidence in the strategies being tested. In a landscape where rapid changes are the norm, ensuring that your data is not just plentiful but precise is the cornerstone of effective and reliable simulations.

Without this critical foundation, even the most sophisticated algorithms may falter, leaving traders ill-prepared for the unpredictable nature of real markets.

Conclusion

In conclusion, while simulations are invaluable tools for honing trading strategies and understanding market dynamics, they often fall short of mirroring the complexities of real-world trading environments. Factors such as slippage, order execution speed, and the depth of market can significantly influence performance outcomes.

To enhance the accuracy of your simulations, it’s crucial to integrate live market data, implement realistic trading conditions, and continuously adjust your strategies based on actual market behavior. By embracing these adjustments, traders can bridge the gap between simulated results and real-world performance, ultimately leading to more informed decision-making and improved trading success.